June is the month, when many campus recruits start with their first job. Sameer Dahane was one of them. While he was excited of a new role, he was equally eager to get his salary so that he can splurge it.

On a casual tea-time discussion with Kapil, his senior, he shared his thoughts on how he plans to buy variety of stuff including an expensive smartphone, an enviable Tab, a luxury watch to flaunt around and so on.

“What are your thoughts on savings ?” Asked Kapil.

Sameer : Yes I have a savings account.

Kapil: Great. And what amount you plan to save and invest ? Or what % of your salary.

Sameer: I am just 25. Do I have to bother about all these things right now ? Shouldn’t I be enjoying life ?

Kapil : No denial that one should enjoy life. But enjoying doesn’t mean irresponsible spending on stuff that is not necessary. You would soon have a family to support.

Sameer : Yes, that’s right !! So I was thinking that I would start saving and investing after I start a family.

Kapil : Well, just for your knowledge, it is easier to save when you don’t have to support a family as your expenses are lesser. After you get married, you would be tempted to spend a lot to have a good time with your partner i.e. outings, gifts etc. Lets say, this happens for first two years. Later on, if you plan a child, then you would have expenses related to child care.

Sameer : You are right !! Never thought on those lines. So do you think 25 years is a good age to start saving and investing??

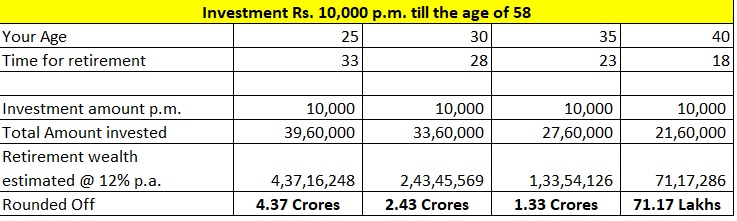

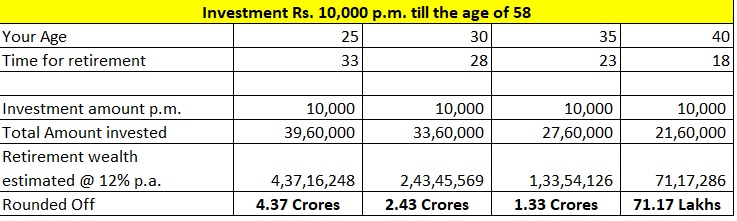

Kapil : I would say, it is the best age. You have time so much on your side. Let’s say that you plan to retire at an age of 58. Since you have 33 years for the same, even a saving of Rs. 10,000 p.m. can grow upto Rs. 4.38 Crores at your retirement age. And if you delay this by even 3 years, your retirement wealth drops to 3.08 Crores. We can say that you will be richer by almost Rs. 1.3 Crores than your colleague Sidharth who is starting at an age of 28.

In fact, you may just have a look at the table below and see the great difference in retirement wealth as you delay your financial planning.

Sameer : This is wonderful !! It sounds like magic !!

Kapil : In fact, this is a wonder !! Einstein the great had called it the 8th Wonder i.e. the Power of compounding.

Sameer : But now the question is, how do I manage to save Rs. 10,000 p.m. I would hardly be able to save anything from my salary after my expenses.

Kapil : For that, you need to change the equation a bit. You are currently doing

Salary – Expenses = Savings

You need to change it to

Salary – Savings = Expenses

Sameer : Sounds nice !! But how do I do that ?

Kapil : Set apart an amount decided for saving and invest it as soon as your salary is credited. And then try and manage your expenses within the balance amount. Human nature is such, we tend to exploit the resources available. If resources are less, we tend to adjust within them. You may follow a few tips as below:

1. Try and minimize use of credit card. Use of credit card is one habit that encourages spending.

2. Make a budget for your expenses. This may sound like a tough job but do it for 2-3 months and you will have a fair idea of where the money is going. You may not need to do it after the initial few months. Now curtail useless expenses. For example, going to an expensive restaurant 3-4 times in a week. Cut it down to once or twice a month.

3. Save your decided amount first. Put it in an investment account. Take this money out of the salary in the beginning of the month so that you don’t touch it.

4. Stop splurging on sale and discount. You often buy things you never need.

5. Don’t pile up old stuff. If there is an old gadget you are willing to replace, try selling the old one along with buying the new one. This will lower your cost by some extent and also help you get rid of cluttering your house. However, Don’t get fooled by the exchange offers. You hardly get any value for your old one there.

6. Don’t succumb to peer pressure to buy every product that is launched in the market. Many youngsters just buy stuff to flaunt. It might earn you some false brownie points today, but you will be a loser in the long run.

Sameer: Thanks Kapil for awakening me at the right time. I will stop splurging and start behaving responsibly so that I secure my future.

We look forward to your feedback and comments on the above article. Please feel free to contact us on saurabh@nidhiinvestments.com if you have any questions.

Disclaimer : (The views mentioned in the article are personal opinion of the author. Mutual Fund investments are subject to market risks. Please read offer document carefully before investing)

#NidhiInvestments

#ProfessorBajaj

#SIP

#BestWealthPlanner

#YourTrustedWealthPlanner

#AdvisorZaruriHai

Published by professorbajaj

Prof. Saurabh Bajaj is an Author, Mentor, Motivational Speaker and Wealth Planner.

He has done his MBA from Narsee Monjee Institute of Management Studies (NMIMS) Mumbai, one of the top 10 management institutes in India. He holds the prestigious FRM (Financial Risk Manager) degree awarded by Global Association of Risk Professionals (GARP), USA. Till date, there are less than 15,000 professionals in the world, who have been honored with this degree. He has also been awarded CFGP (Chartered Financial Goal Planner) Certification by AAFM (American Academy of Financial Management).

After his MBA, he joined J P Morgan, the second largest Investment Bank in the world. He has worked with J P Morgan as Risk Analyst for more than two years.

Prof. Bajaj also holds an Advisory certification awarded by AMFI (Association of Mutual Funds of India). During his stint at Bombay Stock Exchange, he has handled Investment Management and Treasury operations of the BSE Corpus. He has set up an entrepreneurship venture in the field of Wealth Planning and Investment Consulting under the name “Nidhi Investments” and holds the profile of CEO.

Prof. Bajaj sits on the Expert Panel of CAClubindia.com and MBAClubindia.com as Investment Expert.

He is actively involved in investor education through his blog www.professorbajaj.com which has a readership from 78 Countries all over the world. His articles are also regularly published in caclubindia.com , mbaclubindia.com , totalca.com , charteredclub.com, bankbazaar.com and lawyersclubindia.com .

He has been awarded the title of “Best Article Writer” from caclubIndia.com in Jan 2012 and has been selected amongst “Top 5 Technical Writers” from all over India in Feb 2013.

He has been invited by various TV Channels like SPIN TV, CNBC TV18, UTV Bloomberg Etc for programs like "Expert Advice" , "What Markets Want ", "Budget Analysis" etc.

He has been invited by Several organisations like Lions Club, Rotary Club, Agrawal Welfare Foundation, Rajasthan Mandal, Agroha Vikas Trust, Union MF, UTI MF, Arthamitra Gurukulam, Vidyalankar Institute of Technology etc for expert lecture on "Smart Investing", "Life is A Celebration", "Financial Freedom", "The Digital IFA" etc.

He was ranked 8th Merit at All India level NMAT which got him selected for MBA programme at NMIMS, Mumbai. He did his MBA with Capital Markets as his specialisation.

Soft Skills has become an inevitable part of every selection process and teaching learning process these days. The students from small towns and tier II cities, in spite of being talented and well equipped with technical skills, are seen struggling in the selection process. This is because of their lack of exposure to these soft skills. Mr. Bajaj has a zeal for training candidates to develop these skills and has been imparting the same on since last two years. This zeal and passion inspired him to set up his own firm called “Knowledge Circle” which aims to train candidates for soft skills.

Till date, he has trained more than 5000 participants from over 220 organizations across various fields of soft skills.

He has been associated with MSBTE (Maharashtra State Board of Technical Education) to conduct Soft skills training workshop for the faculties of Polytechnic Colleges in Entire Maharashtra (Mumbai Region, Pune Region, Aurangabad Region and Nagpur Region) since last 8 years.

He has also been associated with ICAI (Institute of Chartered Accountants of India) for training CA Students on various topics related to Communications skills, Group Discussions etc.

He was invited by Fr. Agnel Polytechnic College, Vashi for a motivational workshop for faculties. He was also invited by Vivekanad Polytechnic College for "Communication Skills and Email Etiquette" training for non-teaching staff.

Apart from these, he has conducted “Capacity Building Soft Skills workshop for Faculties” at ITI Gunj, ITI Pusad, ITI Digras and ITI Umarkhed. This was the first ever soft skills workshop for faculties in the history of ITI’s in Vidarbha. He was also invited by Shivaji Education Society to conduct similar Soft skills workshops for the faculties and office staff of Shivaji Junior College Pusad, Shivaji High School Pusad, Shivaji Vidyalaya Belora and Shivaji Vidyalaya Bhojla.

He has conducted training workshop on “Effective Presentation Skills” for the relationship managers of HDFC Mutual Fund, Andheri Branch, Mumbai.

He has also been invited at College of Management and Computer Science, Yavatmal, College of Dairy Technology, Warud, B N College of Engineering, Pusad, B D College of Engineering, Wardha, College of Engineering and Technology, Akola, Dr.N.P.Hirani Institute of Polytechnic, Pusad etc. for the Guest lecture on “Developing Interview Skills”.

View more posts

Kaash hume kisine samzaya hota when was out of college. But jab jago tab savera. All youngter’s should take this advice seriously.

Good work sirjee, doing a great job by showing path to youngster who generally get ignored in all savings and investment discussions.

You are amongst the disciplined Category Sir !! You are one of those who guide their colleagues about importance of savings !!

Thanks for your valuable insights and feedback.

Looking forward to more in future !!

Great Formula “Salary – Savings = Expenses”

I think i read it somewhere but now I will follow this regularly. thanks for knowledge sharing

Thanks for the valuable comments.

Yes, this formula is pretty famous and was quoted by Mr. Warren Buffet. Unfortunately, many of us fail to follow it, even if we know it.

Glad to know that you found this useful.

Thanks again for your visit and feedback. Looking forward to more in future.

Finally after 6 months, you got time for writing blog. 🙂

Simple and really a good article to understand and begin your financial planning.

Yes Bro !! This time there was a big gap !!

Thanks for your valuable and insightful comments. Looking forward to more in future !!

Try and minimize use of credit card. Use of credit card is one habit that encourages spending.

Cant agree more!

Very True !!

I would say, Money Saved = Money Earned and Money Invested = Money multiplied = Wealth created.

Another formula is:

Money Saved = Money Earned

So always try to save money 🙂

One Formula took over complete article “Salary – Savings = Expenses”

Well said brother will definitely keep those words and execute that formula for peaceful and happy retirement. 🙂

Thanks for those words of appreciation bro.

Glad to know that you found it useful.

Thanks again for your visit and feedback. Looking forward to more in future 🙂